Currency and economic policy in the middle ages

We live within an abundant and ubiquitous market. From specialist boutiques to supermarkets to sprawling shopping centers, we can easily travel to acquire our hearts desire, or, Acme-like, send a note into the ether and have it delivered to us—sometimes in twenty-four hours. We no longer even need to carry money or the one-to-one representations of it: a credit card will give us the ransom of kings. But if we do want money there is an ATM at the corner 7-Eleven that will dispense what we need. There is no need to go to the banker, the banker is always with us and always ready to say yes. There is no need to negotiate how much of our wheat we must trade for however much butter we need. We sell our time for paper and then trade that paper credit at known prices for what we need and want.

If we don’t like the price on our heart’s desire, someone else makes a different model at a different price. In the best parts of our world, all economic transactions are beneficial to both sides, because both sides are free to take it or leave it, and thus only take it when the trade is at a price they are willing to pay or accept.

This was not always the case, and even today you can travel to places where you are forced to sell or to purchase at prices not of your own choosing1, or where the value of money changes with the corrupt political wind.

Price controls

There are two basic rules of economics:

- People will trade what they are willing to trade.

- If there is a profit to be made, someone will find that profit.

These basic rules mean that:

- Any barriers—natural or artificial—to desired trades increase the profit of those willing to surmount those barriers.

These are laws of nature, just like the laws of gravity. Laws and social pressures can get in their way, but it’s likely to hurt: in reduced quality, increased prices, or hidden costs. They apply to goods, services, and currencies. People will pay the price they are willing to pay, and accept the price they are willing to accept.

Policies can alter that price, but behavior will change. A city government might, to ease rental prices, decree that all unoccupied housing must be leased at or below a specific price. And if it’s not too much trouble, landlords will obey that decree. But if it is too much trouble, they will change their behavior: they will occupy what they once rented; they will give it to their children. They will adopt children and give it to them. They will ask their children to pay to be adopted, and what they ask will be the difference between the decreed price, and the market price, plus an additional fee to cover the dangers of deceiving the city council.

If there is a profit to be made, someone will make it. The question is, who? The more a market is pushed into the shadows, the more it will attract people inclined to break the law.

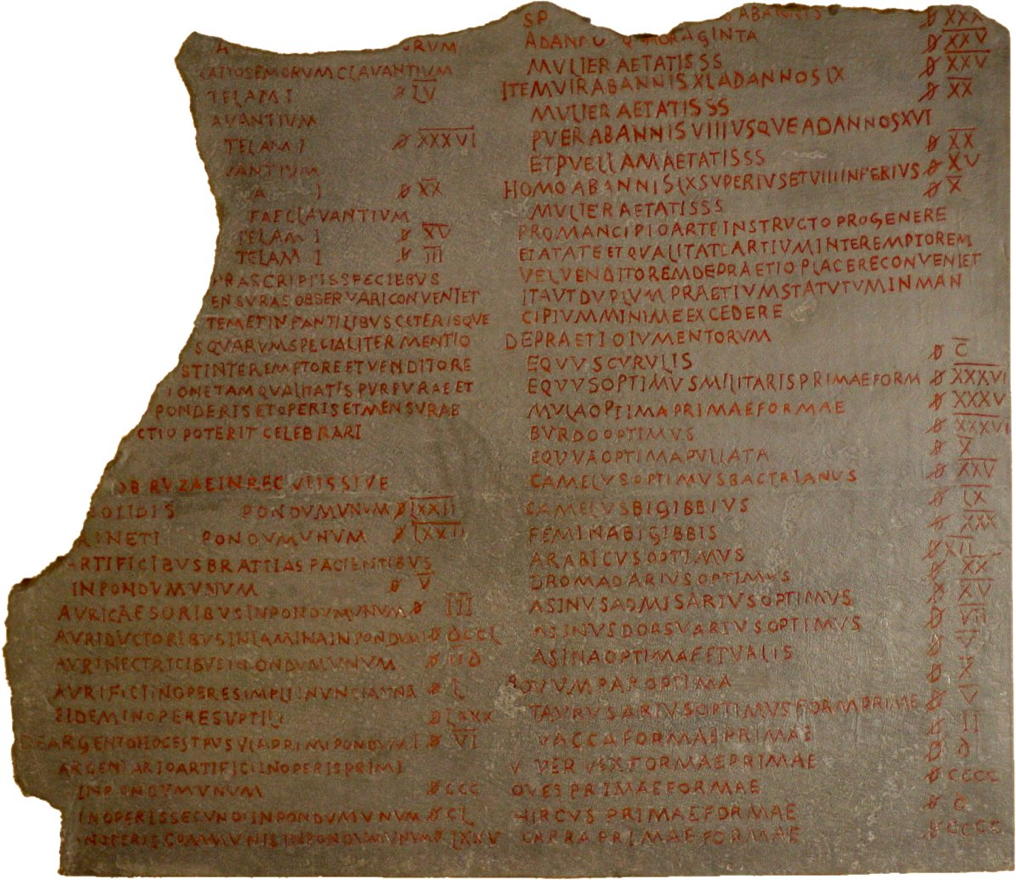

The Austrian economist Ludwig von Mises summarizes the result of price controls in the Roman Empire as fewer goods and thus long lines; this resulted in rationing and an arbitrary distribution scheme. Finally, people opted out of the whole scheme; the Empire tried to make even that illegal. The end result was a declining civilization:

It is certainly true that in the second century A.D., the Roman Empire nurtured a very flourishing civilization, that in those parts of Europe, Asia, and Africa in which the Roman Empire ruled, there was a very high civilization. There was also a very high economic civilization, based on a certain degree of division of labor. Although it appears quite primitive when compared with our conditions today, it certainly was remarkable. It reached the highest degree of the division of labor ever attained before modern capitalism. It is no less true that this civilization disintegrated, especially in the third century. This disintegration within the Roman Empire made it impossible for the Romans to resist aggression from without. Although the aggression was no worse than that which the Romans had resisted again and again in the preceding centuries, they could withstand it no longer after what had taken place within the Roman Empire.

What had taken place? What was the problem? What was it that caused the disintegration of an empire which, in every regard, had attained the highest civilization ever achieved before the eighteenth century? The truth is that what destroyed this ancient civilization was something similar, almost identical to the dangers that threaten our civilization today: on the one hand it was interventionism, and on the other hand, inflation. The interventionism of the Roman Empire consisted in the fact that the Roman Empire, following the preceding Greek policy, did not abstain from price control. This price control was mild, practically without any consequences, because for centuries it did not try to reduce prices below the market level.

But when inflation began in the third century, the poor Romans did not yet have our technical means for inflation. They could not print money; they had to debase the coinage, and this was a much inferior system of inflation compared to the present system, which—through the use of the modern printing press—can so easily destroy the value of money. But it was efficient enough, and it brought about the same result as price control, for the prices which the authorities tolerated were now below the potential price to which inflation had brought the prices of the various commodities.

The result, of course, was that the supply of foodstuffs in the cities declined. The people in the cities were forced to go back to the country and to return to agricultural life. The Romans never realized what was happening. They did not understand it. They had not developed the mental tools to interpret the problems of the division of labor and the consequences of inflation upon market prices. That this currency inflation, currency debasement, was bad, this they knew of course very well.

Consequently, the emperors made laws against this movement. There were laws preventing the city dweller from moving to the country, but such laws were ineffective. As the people did not have anything to eat in the city, as they were starving, no law could keep them from leaving the city and going back into agriculture. The city dweller could no longer work in the processing industries of the cities as an artisan. And, with the loss of the markets in the cities, no one could buy anything there anymore.

Thus we see that, from the third century on, the cities of the Roman Empire were declining and that the division of labor became less intensive than it had been before. Finally, the medieval system of the self-sufficient household, of the “villa,” as it was called in later laws, emerged.

Price controls probably extended the Great Depression in the United States.

In the United States we saw long lines, inflation, and a recession as a result of price controls in the seventies. When it was no longer worthwhile for people to engage in the selling of, say, gasoline, they stopped selling it, or they rationed it out to avoid too high a loss. Black markets arose that met the actual costs of selling, and then tacked on the costs of engaging in a black market. The result was higher prices and scarcity—two things that don’t normally go together in a sound economy. In a sound economy, higher prices encourage entrepreneurs to bring more to market—resulting in lower prices.

In gaming terms, there are several adventures here. Higher prices for rare foreign goods will encourage businessmen to hire adventurers to head into foreign lands to acquire more of that good.

Another way that prices can be controlled is through the creation of guilds. Medieval-style guilds (and some modern ones) raise prices by limiting the number of practitioners able to perform some task or create some product, by limiting the actual number of products that can be created by their members, and by limiting the choices that their members can offer, requiring that products and services match stringent requirements that limit choice.

Denarius from about 82-83 BC. Jupiter on the front, and Victory on the back. The serrated edge is an early version of reeding, a vain attempt to keep chiselers from removing bits of the coin. But with all the trouble they had keeping coinage reliable, it was still orders of magnitude easier and safer to trade in coin than to trade in goods, which are even easier to misrepresent.

Guilds can do this because they are paying the government for a monopoly: anyone not in the guild who does what guildmembers do is breaking the law and can be fined or jailed. Governments love guilds because they are easier to negotiate with than a mass of independents. They also enjoy the fees that the guilds pay for their monopolies. And the money isn’t just the fee: guilds will ensure that the right hands are greased to ensure that no one is allowed to break their monopoly.

Medieval-style guilds will literally kill to keep from having to compete with non-guild labor. The guilds will be willing to hire adventurers, and their targets will be willing to hire adventurers, too.

Currencies

Among my favorite Dragon articles are their two or three articles on ancient and medieval coins. The history of money is fascinating. Coins play an important role in most fantasy games, and for the same reason they play an important role in human economies: because coins are easier to carry than barter goods and are more trustworthy.

Given the choice of carrying out a hundred bushels of wheat worth 500 coins, or just carrying out 200 coins, most adventurers will carry the coins. It’s easier. Once a coinage system is introduced, it’s worth as currency outstrips the worth of goods for barter.

Even bartering will tend to be performed in terms of currency, with each side negotiating the price of their goods in terms of currency, and then trading the amounts that entails.

A currency is something that stands in for value. Before currency, everything was barter (or force). If you wanted a pig, you had to trade at least part of a cow for it or you had to steal it. And the same was true of your pig-owning neighbor who wanted a cow. Which meant that your wealth was measured in things you made or acquired and protected, because cows are not easy to protect.

Representations of such stock are a lot easier to trade and protect. The commodity that the representation represented could be centrally stored and centrally protected, whether it was oxen or grain. Of course, such a currency would collapse if the oxen all died, the grain all burned, or one country stole another country’s commodities.

Coinage solved that problem by putting the commodity into the currency. The currency, rather than being a representation of something else of value, was itself of value: it was copper, or silver, or gold.

This was still a symbolic currency of sorts. Silver and gold were valuable almost solely because people liked silver and gold and they were rare. You couldn’t eat it, or turn it into plows or weapons, or wear it to protect from the elements. It did look cool when turned into jewelry, but that’s a cultural value. Gold necklaces don’t keep out the elements nor assuage your hunger.

If a culture decided that silver or gold was passé, the coins wouldn’t be worth anything in and of themselves, and for the most part such coins were in fact worth more what people pretended they were worth than their actual metal value.

This in itself led to crime: unscrupulous people would scrape off parts of the coins and then continue to use the coins for trade, keeping the part they’d scraped off to be melted down and sold later when they’d accumulated enough of it. This led to reeding coins whose metals were worth something besides being a coin. The grooves around the edges of coins are there to make it easy to see when some of the coin has been scraped off.

Another way to protect the metals is not to hand it out: that is, go back to the old days of handing out notes backed by a certain amount of resource, in this case by a certain amount of gold or silver. The government would protect the metal, such as at Fort Knox, and people would carry around notes that represented a share in the protected metal.

But if money is worth only what people pretend it is worth, and people are trading in slips of paper anyway, why not back those slips of paper with nothing more than the nation’s standing? That’s what paper money has become today: a vast system of let’s pretend, in which you and the person you’re giving money to pretend that the money is worth what you’re getting in return, and that person can then pretend that the money is worth what they get in return for it, and so forth.

Bronze half-groat coin die from Poland circa 1394-1398.

As long as most people are willing to pretend at about the same level, the currency works. If people aren’t, the currency collapses; it might enter an inflationary spiral, or it might simply become worthless.

This is not always a bad thing, at least for governments.2 For as long as we have had currencies, governments have sought to control the worth of that currency. Since creating value is very difficult for a government to do, the chief way of controlling a currency’s value is to debase it:

The Roman emperor in the second part of the third century had only one financial method, and this was currency debasement. In those primitive ages, before the invention of the printing press, even inflation was, let us say, primitive. It involved debasement of the coinage, especially the silver. The government mixed more and more copper into the silver until the color of the silver coins was changed and the weight was reduced considerably. The result of this coinage debasement and the associated increase in the quantity of money was an increase in prices, followed by an edict to control prices. And Roman emperors were not very mild when they enforced a law; they did not consider death too mild a punishment for a man who had asked for a higher price. They enforced price control, but they failed to maintain the society. The result was the disintegration of the Roman Empire and the system of the division of labor.

We see the same thing today. The entire purpose of the Federal Reserve, as far as everyday life goes, is controlling how quickly American money is debased, either through the Federal interest rate or by how much money is allowed to exist.

There’s a lot of financial turmoil going on as I write this because China is debasing their own currency. Their markets are in free-fall because they’re trying to just announce that money is worth less than it was yesterday. When your currency is just pretend, and the government starts acting as if it they’re the only ones whose fantasies matter, it pulls the legs out from under the currency.

In game terms, this can mean that the coins from different eras are worth different amounts. A great adventure could be started because the adventurers run across a rumor of an old coin hoard from a golden age when coins had a much higher percentage of precious metals.

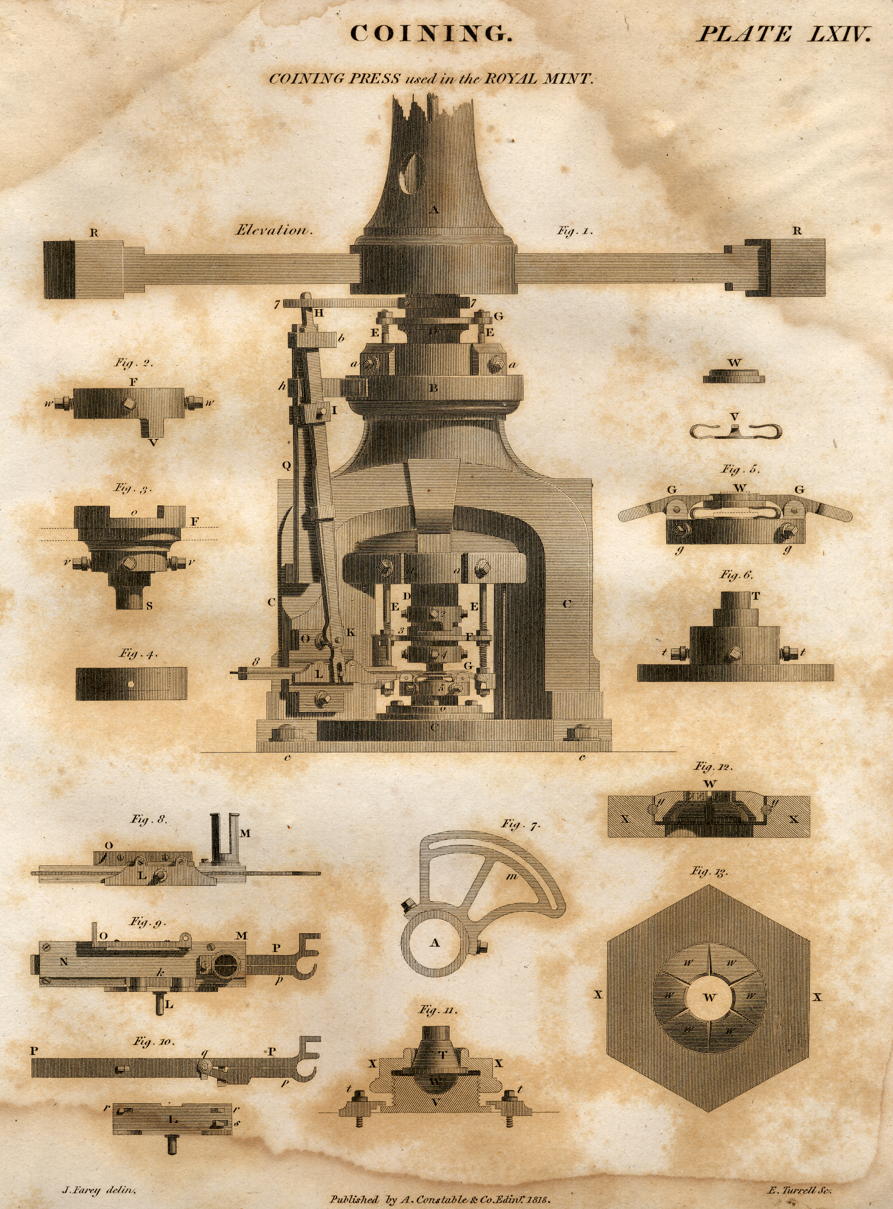

Mints

Question: Why do cities, countries, and organizations mint their own coins?

Answer: Because they can make a lot of money.

Really. It’s not a joke. If you control the production of currency, you can make money off of it. This is why governments tend to make the creation of money a government monopoly, and why, when governments are weak, private parties step in to start their own mints or currencies. Because there’s a lot of money to be made.

Because even precious metal-backed currencies are, in healthy countries, worth more what the country is worth than what the metal is worth, governments can make a lot of money by taking precious metals, minting it into coins worth more than their weight in precious metal, and then using that money to buy things, pay salaries, and loan the money out. This is called seigniorage from, literally, the right of the king to mint money.

It’s so remunerative that governments sometimes forbade the use of foreign coin, forcing visitors to purchase local coin with their own foreign coinage, and providing the government with the seigniorage.

Caroline Dudley, in Saxon and Medieval mints and moneyers in Sussex in Archaeology in Sussex to AD 1500 wrote of the London mints:

Control was exercised by issuing dies only from approved die-cutting centres, which in Sussex’s case would either have been Winchester or London, and only to approved moneyers, who had to pay every time the type changed. Foreign coin had to be reminted or exchanged for the coin of the realm as soon as it was imported.

A much more complex minting operation, this is a coining press used in the English Royal Mint, 1818.

Of course, the gaming potential of having to purchase foreign coins before transacting any business in foreign lands is obvious. When a lot of money is changing hands, a lot of people want in on the action.

Credit

One of the platforms of our modern economy is the easy availability of credit. From bar tabs to store layaways to credit cards, as well as home loans and auto loans on down to payday loans, it isn’t difficult for anyone with any income to receive credit.

Except for bar tabs, none of these apply to medieval economies. Bar tabs sans credit card are made possible by regulars to an establishment; such unofficial forms of credit may be workable in the uniformly small communities of the fantasy medieval world.3

It might seem as though the store layaway would also make sense, but store layaways were made possible by mass production. Without mass production, the merchant is likely to sell the product to the first customer who can pay the full price, making layaways pointless. And once that item is gone, it’s gone. The next item may be similar, but it won’t be exactly the same—and there simply aren’t enough of them to make a layaway program worthwhile.

Home and auto loans are backed by laws that allow the lender to take the home or auto as collateral. If the loan isn’t repaid, the collateral is forfeit to the lender. Without that legal system, lending is purely reputational: can the lender enforce repayment, or is the borrower known to be a good risk?

Credit in a medieval economy comes from the moneylender. Our own history has a neat twist because the Catholic Church forbade moneylending regularly throughout Middle Ages. This, of course, was a great business opportunity for non-Catholics. The prohibition was on lending, not on borrowing (that came from Shakespeare). A lot of the anti-Semitism in the world today might arise from that policy. People have a tendency to resent who they’re indebted to, whether it’s their credit card company, the neighbor who loaned them a bit to tide them over, or the Rothschilds. The moneylender, and his pound of flesh, are rarely portrayed sympathetically in fiction.

As might be expected in a world where loans were heavily regulated and often forbidden, loan rates were very high. The rates approximating our “high-interest” credit cards—15% to 20% or so—were considered quite low, rates of 30% were common, and rates of 40% or more were not rare.

Of course, part of this rate is not just that moneylenders were few, but that the ability to enforce collection could vary as well, making high rates necessary to cover losses. Extremely reliable clients would get lower rates, and governments would generally get a lower rate as well, depending on the circumstances. Shorter-term loans meant higher interest rates just to cover the cost of doing business.

Because there’s so much money to be made in lending, and because there was such a high demand as people began to travel more, many Christians tried to get around the prohibition. For example, the Knights Templar loaned money to travelers; the travelers would deposit property with Templars in their home region and then be able to present a note and borrow money against that property from Templars in other lands. In order to do this, they needed to exploit loopholes in the definition of usury, such as by charging rent on the property deposited rather than interest on the loan provided.

Since organizations similar to the Knights Templar or the Knights Hospitaller, which offered loans in the same manner, abound in fantasy game worlds, moneylending may also be one of their means of survival.

Here in the United States, that’s pretty much what the “Affordable” Care Act is: forcing the purchase of something at prices not of your own choosing.

↑Whether it is good for any particular individual tends to depend on whether that person owes a lot of money—in which case, inflation is good for them, as it reduces the value of their debts—or saves a lot of money, in which case inflation is bad for them, as it reduces the value of their savings.

↑Mind you, this sort of requires modern, more democratic bars.

↑

currency

- Currency at Wikipedia

- “A currency in the most specific use of the word refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially in a nation.”

- An introduction to Roman coins

- “This guide has developed over several years and will be updated further in the near future. It provides a visual aid for the identification of coins commonly found in Britain, covering the following elements: Emperors, Dynasties, Denomination, Mint, Reece period, Personifications, Republican Moneyers.”

- Oxhide ingot at Wikipedia

- “Oxhide ingots are metal slabs, usually of copper but sometimes of tin, produced and widely distributed during the Mediterranean Late Bronze Age. Their shape resembles the hide of an ox with a protruding handle in each of the ingot’s four corners. Early thought was that each ingot was equivalent to the value of one ox. However, the similarity in shape is simply a coincidence. The ingots’ producers probably designed these protrusions to make the ingots easily transportable overland on the backs of pack animals.”

- Paul Krugman’s New Cents

- Money is worth only what we pretend it is worth. If we pretend it’s worth nothing, then it is worth nothing.

- Seigniorage at Wikipedia

- “Seigniorage is the difference between the value of money and the cost to produce and distribute it.”

economics

- Economic Policy: Thoughts for Today and Tomorrow: Ludwig von Mises at Mises Institute

- “Ideally government should be a sort of caretaker, not of the people themselves, but of the conditions which will allow individuals, producers, traders, workers, entrepreneurs, savers, and consumers to pursue their own goals in peace. If government does that, and no more, the people will be able to provide for themselves much better than the government possibly could.”

- Medieval Sourcebook: Æthelred Unrædy: The Laws of London, 978 at Internet Medieval Sourcebook

- “For so long as Ethelred ruled over England the standard for London in the matter of coinage was the standard for all his dominions. His regulations about counterfeiting were applied to all towns under his jurisdiction. The reduction in the number of mints had as its object a better coinage system through more careful supervision. But Ethelred was a weak king and doubtless he did not enforce his laws.”

- Money Lending in the Middle Ages: Katherine Ashe

- “There is an impression abroad that money lending was forbidden to Christians during medieval times. It certainly was not. In fact the principal bankers to the lordly class were the knightly Orders, the Hospitallers and the Templars, and the Church itself was not above acting as collection agent for even the worst of usurers.”

- The Morality of Moneylending: A Short History: Yaron Brook

- “This treatment of moneylenders is unjust but not new. For millennia they have been the primary scapegoats for practically every economic problem. They have been derided by philosophers and condemned to hell by religious authorities; their property has been confiscated to compensate their ‘victims’; they have been humiliated, framed, jailed, and butchered. From Jewish pogroms where the main purpose was to destroy the records of debt, to the vilification of the House of Rothschild, to the jailing of American financiers—moneylenders have been targets of philosophers, theologians, journalists, economists, playwrights, legislators, and the masses.”

More currency

- Money Changes Everything: Empowering the vicious

- Barbarism empowers the rich, the powerful, the vicious, the strong. Civilization empowers everyone else. Gun control and centralized economies, darlings of the progressive left, have empowered the vicious since the beginning of time. The beltway crowd prefers no competition from people free to barter, or free to defend themselves.

- Ariel Burr, first woman on U.S. currency

- Trans female and founder finally overcomes 19th century transphobia and political rival as first woman on United States paper currency. Ariel Burr will be the new face of the ten dollar bill, says Jack Lew.

More gaming history

- The Cult of the Cult of Gygax™

- It was never a secret to us back in the day that the staff at TSR played the game themselves, and that they played the game with custom rules and custom worlds.

- Was table-top gaming inevitable?

- Gods & Monsters rolls an 18 for age today, pioneer game writer Greg Stafford died two weeks ago, and stories about the early days of gaming has me wondering, was the discovery of table-top gaming a perfect storm, or was it inevitable?

- The First Language

- Scholars once believed that, or seriously discussed whether, Hebrew was the first language of mankind. In a fantasy game, there really can have been a first, holy language of the gods.

- House of Gold, House of Passages

- The emperor Nero’s House of Gold sounds like the backstory of a great megadungeon right under the adventurers’ sandaled feet.

- The Yuma Territorial Dungeon

- The Yuma Territorial Prison looks like a great dungeon setting. It’s history provides inspirational ideas for more fantastic dungeons.

- 18 more pages with the topic gaming history, and other related pages

More Medieval Life

- The domestication of frozen water

- Even the poorest people have ice today. Ice is given away free to dilute already-cheap sugary drinks. You can buy it in huge bags outside at gas stations and convenience stores, and when it melts you can get some more. In medieval times, you had no such luxury. Ice came in the winter and left in the summer. Storing it was time-consuming, expensive, and even dangerous.

- The well of life: the revolution of reliable water

- Water is practically a modern invention: we use it far more today than we did a hundred years ago and we trust it more than we did a hundred years ago. Today reliable water is ubiquitous, and we complain if a building doesn’t have running water.

- How to build a fire

- The best way to make a fire is to start with a fire.